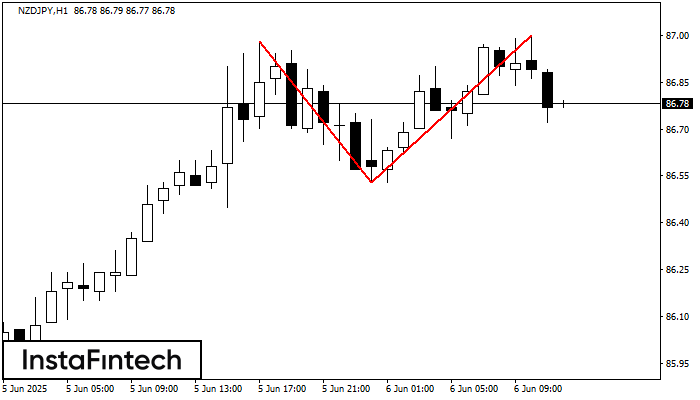

signal strength 4 of 5

On the chart of NZDJPY H1 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 87.00; the lower boundary 86.53; the width of the pattern 47 points. The signal: a break of the lower boundary will cause continuation of the downward trend targeting the 86.13 level.

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

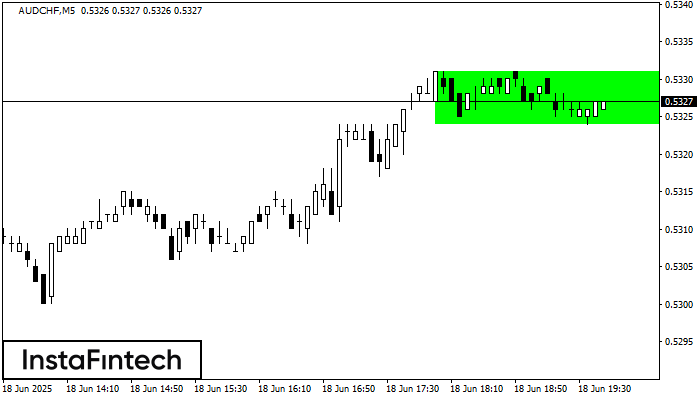

According to the chart of M5, AUDCHF formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 0.5331, the lower border is 0.5324. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Double Bottom pattern has been formed on #MCD M5. Characteristics: the support level 290.06; the resistance level 291.55; the width of the pattern 149 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

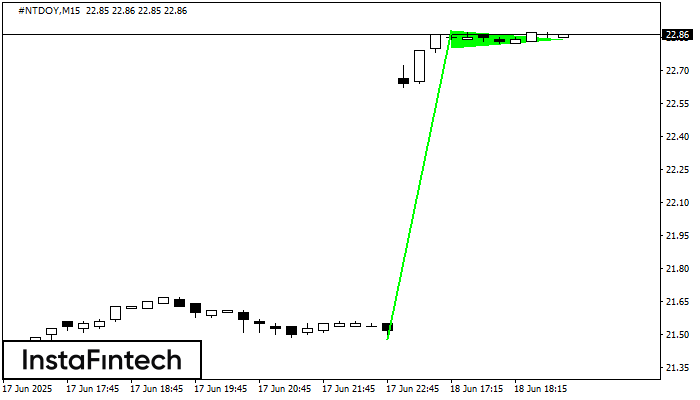

Open chart in a new windowThe Bullish pennant pattern is formed on the #NTDOY M15 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

The M5 and M15 time frames may have more false entry points.

Open chart in a new window