The week ahead promises volatility for all dollar pairs. The market will react to the outcomes of the Geneva meeting between US and Chinese representatives. Furthermore, key inflation data for the United States will be released. Third, we'll hear from many Federal Reserve officials—including Jerome Powell, who is scheduled to speak on Thursday. All of this suggests the EUR/USD pair will remain in a zone of strong price turbulence in the near future.

The No. 1 topic is the upcoming negotiations between the US and China. The likelihood of both sides sitting down for formal negotiations has significantly increased following the preliminary outcomes of the first round of the Geneva meeting. A preliminary meeting was held between the US Treasury Secretary and the Chinese Vice Premier for economic affairs in Switzerland. Given the level of representation, traders have high hopes that this meeting could mark the beginning of a full-scale negotiation process.

Judging by Donald Trump's initial comments, these hopes may be justified. According to the US president, there has been "major progress" with China that could lead to a "total reset." He stated that the meeting in Geneva was "very good," with "a lot discussed and a lot agreed on."

Negotiations continued on Sunday. If China echoes Trump's optimism (Beijing has not yet commented on Saturday's meeting), the dollar will receive substantial—and more importantly, long-term—support. While full-scale trade talks may take weeks or months, the market will respond positively to any progress in the short term. The dollar would benefit from the fact that movement has resumed after four weeks of tariff standoff.

However, if China responds coolly to the Geneva talks, the dollar will come under pressure again. This is possible, as neither Trump nor White House officials provided details about day one of the talks in Switzerland. No official press statements were made in Geneva. So, dollar bulls should not celebrate just yet: if we abstract from Trump's enthusiastic statement (voiced even before the second round of negotiations in Geneva), the prospects for a significant breakthrough in negotiations still look vague. The future will depend on official commentary from both the White House and, especially, Beijing.

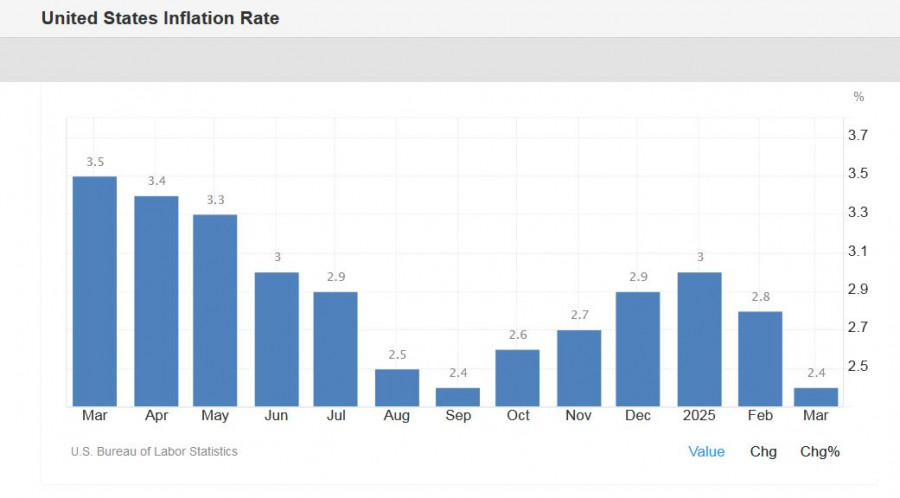

Beyond the negotiation narrative, key US macroeconomic reports will influence EUR/USD—most importantly, inflation data.

April's Consumer Price Index (CPI) will be released on Tuesday, May 13. Since Trump's tariff plan was already in effect in April, traders will assess how quickly and significantly these duties impacted inflation. CPI is expected to remain at 2.4% y/y, while core CPI could rise to 3.0% (after rising to 2.8% in the previous month).

Another important inflation indicator—the producer price index — will be released in the United States on Thursday, May 15. A similar picture is expected here: the overall PPI should remain at the level of the previous month (2.7% y/y), and the core index should accelerate slightly to 3.5% (from the previous value of 3.3%).

Significant inflation indicators will also be published on Friday, May 16. We will learn the consumer sentiment index from the University of Michigan. This indicator should demonstrate an upward trend in May (to 53.1) after four months of consistent decline. Special emphasis will be placed on the inflation expectations indicator, which is also calculated by the University of Michigan. In April, this indicator jumped to 6.5% (the highest value since 1981). If inflation expectations increase in May (unfortunately, there are no preliminary forecasts), dollar bulls will react negatively to this fact, since the market will again talk about the risks of stagflation.

However, the "stress resistance" of the American currency will depend primarily on the results of the Geneva meeting. If the US and China agree to start negotiating positions in Switzerland and follow the path of de-escalation, the dollar will withstand all other (possible) blows. That is, macroeconomic reports will be viewed through the prism of future negotiations. Let's say that if, contrary to forecasts, CPI and PPI accelerate significantly, traders will not emphasize this fact unless the US and China engage in negotiations. Otherwise, each negative signal of a macroeconomic nature will worsen if negotiations fail.

In addition to inflation reports, other rather important releases will be published in the coming week.

Thus, the ZEW Institute's May indices will be released during Tuesday's European session. After the dismal April result, positive dynamics are expected here. For example, the German business sentiment index is expected to rise to 9.8 in May after falling to -14 in the previous month.

The final German inflation growth data will be released on Wednesday. The final estimate is expected to coincide with the initial one (total CPI growth to 2.1% y/y, harmonized CPI to 2.1% y/y).

Aside from PPI, the key release for EUR/USD on Thursday is the U.S. retail sales report. According to forecasts, total sales declined to zero in April (after a 1.4% increase in March), while excluding auto sales, sales rose by just 0.3%. Also on Thursday, the manufacturing activity index from the FRB Philadelphia will be released (the index is expected to come in at -9.9, after falling to -24 in April) and the NY Empire State manufacturing activity index (forecast at -7.9 after falling to -8.1). In addition, this day we will learn the dynamics of industrial production growth in the U.S. - according to forecasts, the volume of production in April should increase by 0.3% after a decline of 0.2% in the previous month.

Friday will see the release of the aforementioned University of Michigan inflation indicators, as well as data on the volume of building permits issued in the US (expected to decline by 0.9%) and the volume of completed new housing starts in the US (also expected to decline by 12.4%).

In addition, several Fed officials will speak during the week: on Monday - Thomas Barkin, head of the Federal Reserve Bank of Richmond, and Adriana Kugler, member of the Board of Governors, on Wednesday - Fed Vice Chairman Philip Jefferson, on Thursday - Mary Daly, head of the Federal Reserve Bank of San Francisco, Michael Barr (in February he left the position of Fed Vice Chairman for Supervision, but remained as a member of the Board of Governors) and finally - Fed Chairman Jerome Powell. Of course, the primary focus will be on Powell's speech, where he is expected to reiterate key points from the May meeting. Specifically, he will likely emphasize that the Fed is in a "good position" to wait for more clarity regarding the impact of tariffs on the US economy. Again, much will depend on how the Geneva meeting ends - if the outlines of a possible deal between Washington and Beijing appear on the horizon, the tone of Powell's rhetoric will be more optimistic, and this fact will provide additional support to the greenback.

Thus, the vector of EUR/USD movement will depend primarily on the outcome of the US-China negotiations in Geneva. All other fundamental factors will be considered exclusively through the prism of the negotiation track - either the dollar will get support and a certain "immunity" (if the Geneva meeting ends successfully), or the dollar will be in a very weak and vulnerable state (if, contrary to Trump's statements, the negotiations fail). The wait is not long - at the start of the new trading week, EUR/USD traders will evaluate the "Swiss Weekend" and will give their verdict, in the form of strengthening or weakening of the U.S. currency.