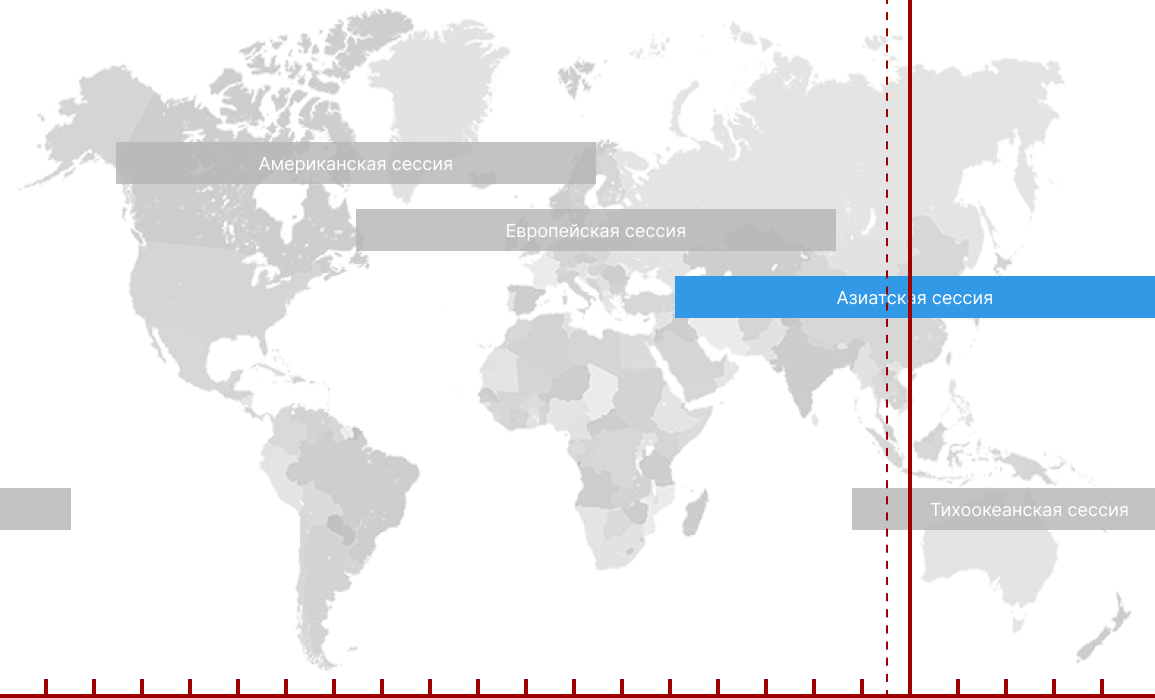

Features of trading sessions

At night quotes usually move slowly, while in the daytime the volatility increases sharply. Trading sessions on Forex differ in working hours and some trading peculiarities, e.g. the most traded currency, the volatility level, and the impact of fundamental factors.

Forex trading starts with the opening of the Pacific trading session. This is the calmest session. It is characterized by rather low volatility compared to other sessions. As a rule, the market stands still and quotes move sideways. Savvy speculators usually do not open trades during this period. Nevertheless, they continue to monitor the market movements, the breakout of some psychologically important or historical levels, as well as the formation of a new trend or price reversals.

For beginners, the Pacific session is the most suitable period for training and opening the first trades as the risk is low. In addition, some automated systems configured for flat trading may be rather effective during this session. However, there may be some periods of increased volatility, for example, when the Federal Reserve announces the results of its policy meeting. The market reaction to the Fed’s decisions can be quite sharp. So, it is sure to have a significant impact on the price dynamic.

In the Pacific session, AUD/USD and NZD/USD are the most traded currency pairs. The thing is that the Australian and New Zealand dollars are the national currencies of the Pacific countries.

After the opening of the Asian session, trading volumes increase and quotes begin to move faster. Trading is unfolding briskly, especially in the first hours of the trading session. At this time, the main economic reports are published, especially in Japan, Australia, and New Zealand.

EUR/JPY, USD/JPY, and the Australian dollar (AUD) are the most traded assets during the Asian trade. Meanwhile, the EUR/USD pair attracts the attention of traders thanks to its volatility in every trading session. According to statistical data, if a pair shows sharp changes during the US trade, it is likely to rise during the Asian session.

As a rule, low volatility is typical for the Asian session. Mots currency pairs hover within narrow ranges, thus preparing for more considerable movements during the following trading hours. Asian stock exchanges often set a trend for the rest of the trading day.

Since the market volatility is moderate, traders can use any trading strategy. Taking into accoun steady price changes, traders act as hunters. They have to be patient and wait for long time for the prey, but a good shot can bring a decent profit.

The European trading session is the busiest and most eventful. Since the trading volume is big, the market activity is high. In general, stable trends are formed during the European session. Traders should keep in mind this fact. What is more, during the European session, there are a lot of false signals. The fact is that European dealers test the market, searching for the accumulation of stop orders and spot support and resistance levels.

The start of the trading session is usually calm. The price movements accelerate at the moment of opening of the London Stock Exchange. This is the best period for traders since volatility is really high and EUR, USD, and GBP manifest increased activity.

The highest activity is usually seen at the beginning and end of the trading session. In the second part of the day, traders take a short pause. The price trends alter at end of the session.

During the European session, traders may choose any currency pair. However, more often, they prefer trading EUR/USD, GBP/USD, USD/JPY, USD/CHF, as well as crosses such as EUR/JPY and GBP/JPY.

Experienced traders lean to the European trading session with its ample opportunities for getting a decent profit. An ability to analyze a bulk of information and quickly determine the market trend may lead to good results.

A surge in trading activity usually takes place during the US session. Big investors put in large sums of money, thus attracting traders from all over the globe. The US trade is the most aggressive, unpredictable, and potentially profitable. Traders are mainly focused on the news releases, which often spur mixed and chaotic currencies’ movements. The trend formed during the European session may either continue or reverse during the US trade.

From a geographical point of view, the US trade covers not only the United States but also Canada and Brazil. Traders pay close attention to the currency pairs that contain USD and CAD. In addition, pairs with JPY also become very volatile during this period. Those traders who are not afraid of price swings open orders on such crosses as GBP/JPY and GBP/CHF.

There is one more peculiarity. It is no secret that European banks are as influential as American ones. That is why the first ones partially offset the importance of the latter ones. Given this fact, the highest volatility is seen at the closure of the European session when US banks get maximum power.

By late Friday, the activity of the US market falls. Traders lock in profits before leaving the market. After that, we can see a bounce of the main assets.