Cautious Gains After Crash

U.S. stock markets showed cautious gains on Wednesday, helped by new inflation data that came in below expectations. This temporarily eased the wave of sell-offs that had swept the stock market earlier. However, the unfolding trade confrontation initiated by U.S. President Donald Trump continues to curb investors' desire to buy.

Tech on the rise, Dow indecisiveness

The S&P 500 and Nasdaq ended the day higher, with the Nasdaq getting a strong boost from tech stocks. Meanwhile, the Dow Jones vacillated between gains and losses throughout the session and closed marginally lower.

Inflation under control, Fed may make concessions

The US Labor Department data showed a sharper decline in consumer prices than analysts had expected, bolstering hopes that inflation is under control and that the Federal Reserve may respond by easing monetary policy by cutting its key interest rate this year.

New round of trade standoff

Meanwhile, Washington announced the introduction of 25% tariffs on steel and aluminum imports. In response, Canada and the European Union announced mirror measures against American exports. The move further heated up trade relations between the US and its largest economic partners.

Investors fear recession

Markets continue to feel pressure amid the growing tit-for-tat tariff confrontation. Investors fear that a sharp rise in prices for imported goods will lead to an economic slowdown and could trigger a recession not only in the US, but also in Canada and Mexico.

Analysts at major investment banks share these concerns. Thus, Goldman Sachs revised its forecast for the S&P 500 index downwards, and J.P. Morgan notes the increasing risks of an economic downturn in the US.

The stock market is balancing between hopes for lower interest rates and fears about the consequences of a trade war. How exactly these conflicting factors will affect the economy will be shown in the coming months.

S&P 500 tries to stay above a critical level

Despite Wednesday's growth, the S&P 500 index remains 8.9% below its all-time high, set less than a month ago. At the start of the week, the key indicator broke below its 200-day moving average for the first time since November 2023 — an important technical level that traders perceive as critical support.

Nasdaq officially in correction zone

The Nasdaq technology index confirmed its entry into the correction phase on March 6, having lost more than 10% from its peak on December 16. This means that the tech sector is under serious pressure, and investors are increasingly wary of its prospects for further growth.

Mixed dynamics: Nasdaq rises, Dow loses ground

The results of the trading session on Wednesday showed different dynamics among the key indices.

- The Dow Jones Industrial Average (.DJI) fell by 82.55 points (or -0.20%) to 41,350.93;

- The S&P 500 (.SPX) rose 27.23 points, or +0.49%, to 5,599.30;

- The Nasdaq Composite (.IXIC) added 212.36 points, or +1.22%, to 17,648.45.

The Nasdaq's gains were driven by a surge in technology stocks, while consumer staples and healthcare sectors underperformed.

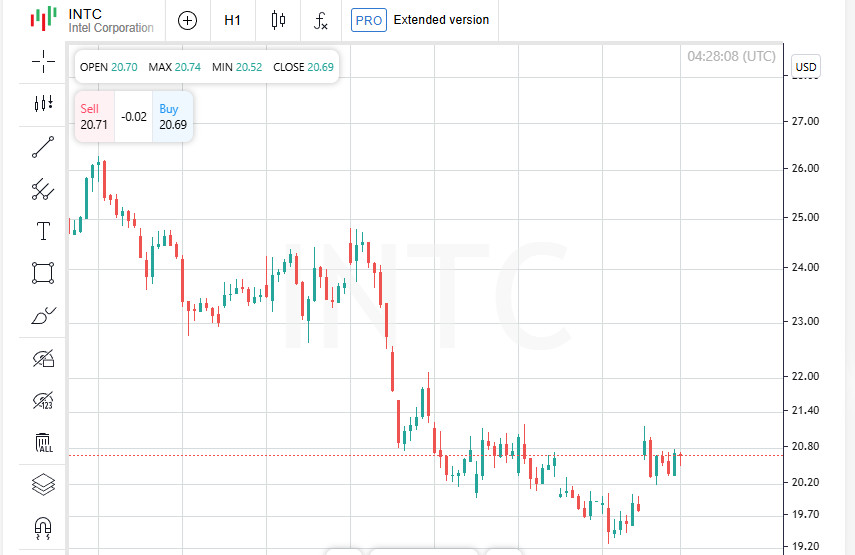

Tech in Focus: Intel on the Rise

Tech stocks were the engine of growth. Among the 11 key sectors that make up the S&P 500, technology was the best performer. Intel (INTC.O) rose 4.6% after reports that Taiwan's TSMC (2330.TW) has asked major U.S. chipmakers Nvidia (NVDA.O), Advanced Micro Devices (AMD.O) and Broadcom (AVGO.O) to consider buying a stake in a joint venture that runs Intel's factories. The news has sparked optimism among investors because such a partnership could strengthen Intel's market position and reduce the U.S. semiconductor industry's reliance on Asian suppliers.

PepsiCo Disappoints Markets

While the tech sector has pleased investors, not all companies have been able to maintain a positive mood.

PepsiCo shares fell 2.7% after Jefferies analysts revised their recommendation on the giant's shares, downgrading their rating from buy to hold. This affected investor sentiment, since rating changes for large companies often serve as an indicator of potential risks.

Congress under pressure: the threat of a shutdown remains

The heated debate on Capitol Hill over the bill on temporary funding of the US government continues. Lawmakers are unable to reach a compromise, increasing the risk of a partial shutdown of government agencies. This political instability is increasing nervousness in stock markets, adding another factor of uncertainty to an already difficult economic picture.

Asian markets pick up growth following Wall Street

Asian stock markets showed confident growth on Thursday, following the positive dynamics of American indices. Easing inflation pressures in the U.S. have reassured investors, sending technology stocks higher.

- Japan's Nikkei (.N225) added 0.9%, helped by gains in chipmakers including Advantest and Tokyo Electron;

- Taiwan's tech index (.TWII) rose 0.6%, while South Korea's KOSPI (.KS11) added 0.7%;

- Chinese blue chips (.CSI300) were up a modest 0.1%, but Hong Kong's Hang Seng lost 0.3%, giving up early gains.

Investors in the region continue to closely monitor trade and geopolitical factors that could shape the markets going forward.

Bonds under pressure: yields remain high

U.S. Treasury yields have maintained high yields after a recent rebound. The rise in rates was triggered by the escalation of trade disputes between the United States and its key economic partners. Investors fear a further escalation of tariff wars, which could put pressure on global markets and slow economic growth.

Euro remains stable despite US threats

On the currency market, the euro held its ground after falling from a five-month high on Wednesday. Pressure on the single currency increased after President Donald Trump said he would retaliate against the European Union if Brussels goes ahead with plans to impose new tariffs on American goods.

However, the euro continues to receive support from investors amid signs of progress in negotiations between Russia and Ukraine. An improving geopolitical situation in Europe could mitigate risks and support the single currency in the short term.

US Price Growth Slows, But Inflation Risks Remain

New US inflation data showed that consumer prices rose 0.2% in February, well below the 0.5% jump in January. Excluding volatile components such as food and energy, the core consumer price index also rose 0.2%, slowing from 0.4% in the previous month.

These figures confirmed market expectations that inflation pressures could ease, but analysts cautioned that the Federal Reserve is looking not only at the consumer price index (CPI), but also at the personal consumption expenditures (PCE) price index. The key components that drove the CPI decline are not included in the PCE calculation, leaving questions about the Fed's future monetary policy.

Investors are also looking ahead to the producer price index (PPI), due later on Thursday, which could provide further clues about whether the decline in inflation is here to stay or is temporary.

US Treasury yields rise again

Uncertainty over global trade and ongoing tariff wars have pushed US Treasury yields higher, recovering from recent lows.

The yield on the 2-year Treasury note rose to 4.005% on Wednesday after falling to 3.829% the previous day, the lowest since October last year;

The yield was last at 3.924%, signaling that investors are pricing in potential changes in Fed policy.

The rise in yields shows that market participants are becoming less confident that interest rates will be cut soon, despite slowing inflation.

Dollar Holds Ground, But Markets Wary

The U.S. dollar was supported by rising bond yields, holding steady against the euro.

The dollar held at 1.0895 per euro on Thursday, after weakening to 1.0947 on Tuesday, its lowest since Oct. 11.

Despite the relative stability, the dollar remains under pressure. Investors fear that the Trump administration's trade policies, including new tariffs, could lead to an economic slowdown and, in the worst case, a recession. These risks are prompting traders to take a more cautious approach to the U.S. currency.

Yen Weakens After Jumping to October Highs

The traditionally safe-haven Japanese yen retreated to 146.205 per dollar after hitting its highest since Oct. 4 at 146.545 on Tuesday.

The sharp rise in the Japanese currency was caused by increased demand for safe assets amid market instability. However, the correction in the rate indicates that investors are partially taking profits and assessing future prospects.

Japanese bond yields are slowing down

After a rapid rise, the yield on 30-year Japanese government bonds has begun to roll back down. On Thursday, the indicator fell to 2.53%, after reaching 2.615% on Wednesday, which was the highest level since 2006.

Bank of Japan Governor Kazuo Ueda commented on this growth, saying that it is a natural reflection of market expectations of future rate hikes. Thus, the regulator confirms its determination to gradually move away from ultra-soft monetary policy, which may lead to a further change in the dynamics of the Japanese debt market.

Gold on the rise, approaching historical highs

Gold prices continue to move higher, reflecting increased demand for safe assets. The precious metal added 0.3% to $2,943.49 per troy ounce. This level is only $13 below the all-time high of $2,956.15 recorded on February 24.

Investors continue to invest in gold amid global economic uncertainty and possible changes in Federal Reserve policy.

Oil market stabilizes after rapid growth

After an active rally on Wednesday, oil prices have slightly retreated.

- Brent futures fell by 0.1% to $70.88 per barrel;

- American WTI oil lost 0.2% to $67.57 per barrel.

The stabilization of prices is associated with a balance between concerns about demand and supporting factors, such as data on the reduction of US inventories. Market attention is focused on the upcoming OPEC+ decisions and the dynamics of global demand for raw materials.

Bitcoin continues to recover from recent declines

The cryptocurrency market is showing signs of recovery. Bitcoin has gained 1%, reaching $84,000. This happened after the largest cryptocurrency sharply fell to $76,666.98 on Tuesday, which was its lowest value in four months.

The recovery of digital assets can be attributed to the renewed interest of institutional investors and the general improvement in sentiment in the cryptocurrency market. However, high volatility remains a key factor that market participants continue to closely monitor.