The GBP/USD currency pair saw a slight downward correction after Monday's rise, which came out of nowhere. However, it's difficult to call this minor move a "dollar recovery." The U.S. dollar rarely strengthens, and each occurrence is a genuine surprise. Donald Trump continues to amuse himself and "rule the world," as he stated yesterday, while Congress, in the meantime, is preparing yet another impeachment motion against the U.S. president.

The topic of impeachment now brings nothing but a smirk. During Trump's first term, Congress attempted to impeach him twice, and both times, the effort failed due to insufficient votes. It's worth noting that although America presents itself as a democratic country, we see quite the opposite in practice. All Republican politicians stand firmly behind Trump, regardless of what he does. So, if Trump were to start World War III for no reason tomorrow, even then, he likely couldn't be removed from office. Essentially, the U.S. president can do whatever he wants as long as he has the backing of his party. How can that be called democracy?

Party loyalty is also driven by self-interest. Republican lawmakers understand that a majority of Americans voted for Trump a second time, and so no one dares to oppose him publicly. In essence, Trump wields super-power status. He doesn't need congressional approval since he can declare a state of emergency and start unilaterally issuing decisions. So, what's the point of Congress or the Senate if they can just be sidelined whenever they get in the way?

Representative Shri Thanedar from Michigan introduced articles of impeachment in Congress, stating that Trump is destroying America and that all of his actions are unconstitutional and harmful to the country. Thanedar listed as many as seven violations committed by Trump in the first 100 days of his new term. However, even if Trump violated 107 articles of the Constitution, as long as two-thirds of the Senate don't vote in favor of his removal, he will remain president. Republicans don't have 67 votes out of 100 in the Senate. So, it is already highly likely that this impeachment attempt will fail. Therefore, speaking of democracy in this context is pointless — the U.S. political system is simply a tug-of-war between parties. Whatever Trump does while in power, it's nearly impossible to remove him because Republican lawmakers will always protect him.

What would it take for Trump's party to turn against him? That's a scenario straight out of science fiction. It's unlikely that Trump would ever deliberately alienate his party — and why would he when it's his only real path to another four years of power? Consequently, impeachment is virtually impossible under the current political system.

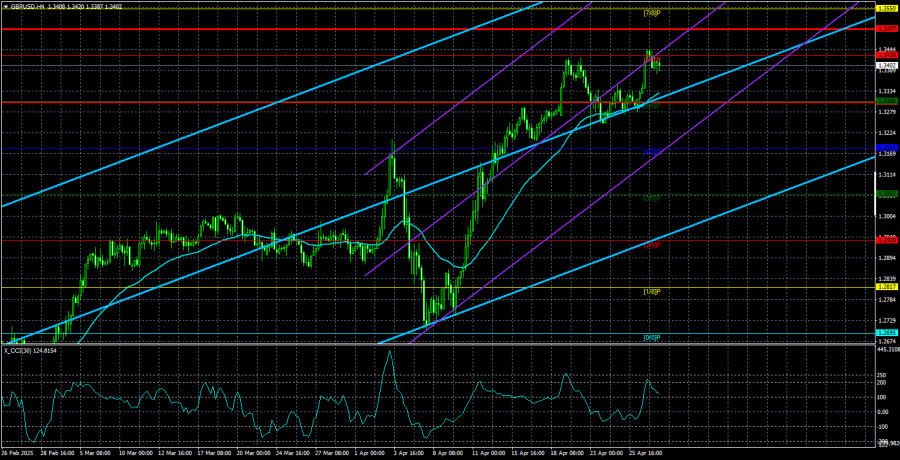

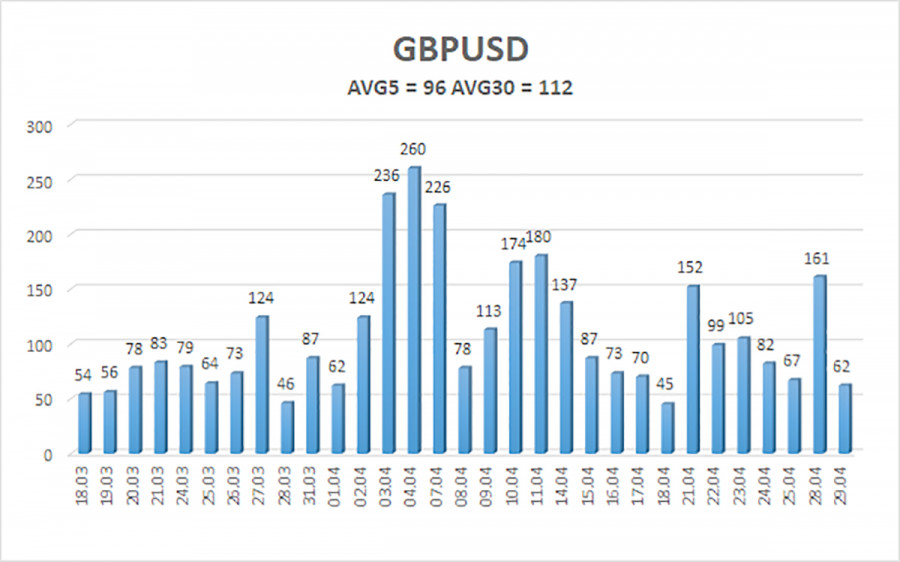

The average volatility of the GBP/USD pair over the past five trading days stands at 96 pips, which is considered "average" for this currency pair. Therefore, on Wednesday, April 30, we expect movement within a range bounded by 1.3305 and 1.3497. The long-term regression channel is pointing upward, indicating a clear bullish trend. The CCI indicator has once again entered overbought territory, but in the context of a strong uptrend, this typically signals only a possible correction.

Nearest Support Levels:

S1 – 1.3306

S2 – 1.3184

S3 – 1.3062

Nearest Resistance Levels:

R1 – 1.3428

R2 – 1.3550

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair continues its confident upward trend. We still believe the pound has no fundamental reason to rise — it's not the pound that's strengthening; it's the dollar that's falling. And the dollar is falling solely because of Trump. Therefore, Trump's actions could easily trigger a sharp downward reversal. If you're trading based on pure technicals or "the Trump factor," long positions remain valid with targets at 1.3497 and 1.3550, as the price is currently above the moving average. Short positions are still attractive, but now, the market shows no interest in buying the U.S. dollar, and Trump continues to provoke fresh dollar sell-offs.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.