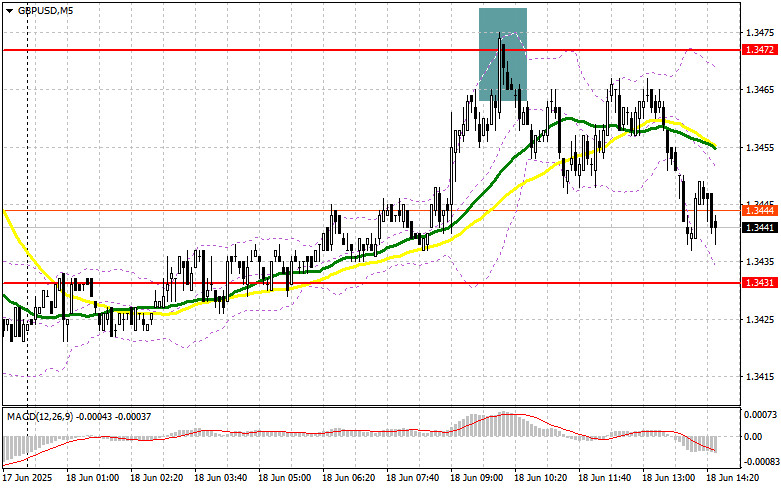

In my morning forecast, I focused on the 1.3472 level and planned to base market entries around it. Let's examine the 5-minute chart and analyze what happened. The upward move followed by a false breakout at 1.3472 provided an excellent entry point for selling the pound, resulting in a drop of more than 30 points. The technical picture has been revised for the second half of the day.

To open long positions on GBP/USD:

UK inflation data came in as expected, which limited the pound's bullish potential in the first half of the day. From here, market focus shifts to the FOMC's rate decision and Jerome Powell's press conference. Weekly jobless claims and U.S. building permits are unlikely to have a significant impact before the Fed announcement. A dovish stance from Powell—something President Trump has been advocating—could restore demand for the pound and lift GBP/USD.

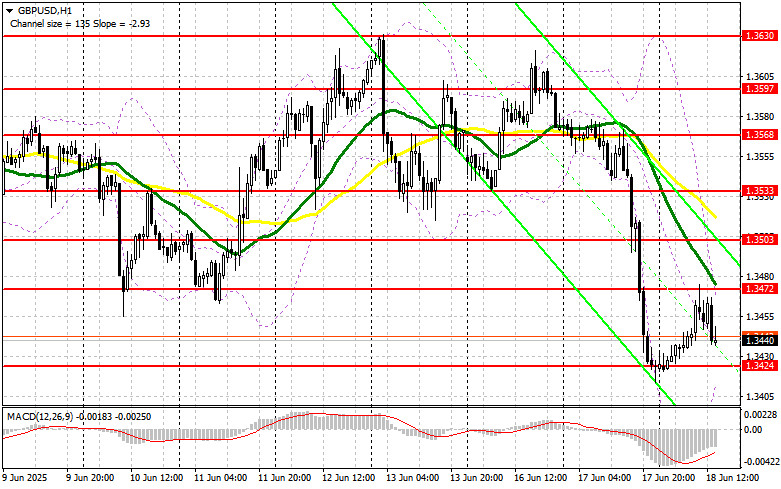

If the pair declines, I would act near the new support at 1.3424, formed earlier today. A false breakout at this level would present a good buying opportunity, targeting resistance at 1.3472. A breakout followed by a downward retest of this range would create another long entry point, aiming for 1.3503. The most distant target would be 1.3533, where I plan to take profit.

If GBP/USD drops further and bulls remain inactive around 1.3424, pressure on the pound may intensify. In that case, only a false breakout near 1.3391 would provide a suitable long entry. I plan to buy GBP/USD on a rebound from 1.3343 for a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers have done their part and performed well in the first half of the day. Focus now shifts to the 1.3472 level, where the moving averages are located and currently support the bears. A false breakout at this level—similar to what occurred earlier—would justify a short entry targeting support at 1.3424, which was narrowly missed earlier. A breakout and retest from below would trigger stops and open the path toward 1.3391. The final target would be 1.3343, where I plan to take profit.

If demand for the pound returns later in the day and bears remain passive around 1.3472—where the moving averages are located—GBP/USD could stage a larger upward move. In this case, it would be better to wait until a test of the 1.3503 resistance level to consider selling. I will open short positions there only if a false breakout forms. If there's no downward movement, I'll look for a short entry on a rebound from 1.3533, expecting a 30–35 point intraday correction.

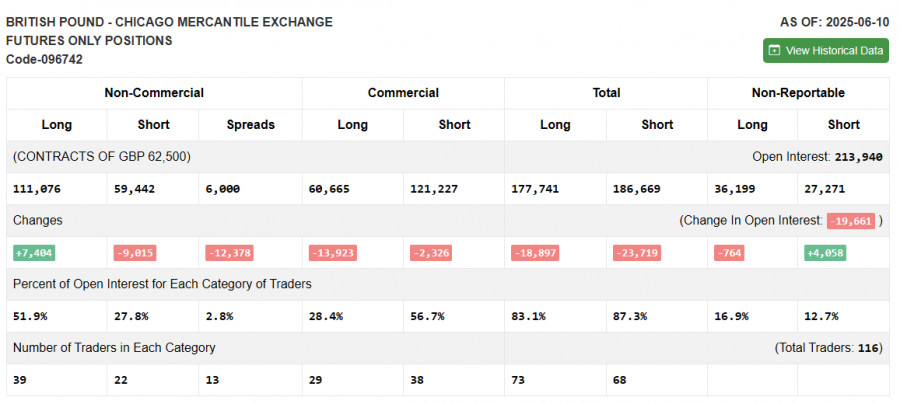

Commitment of Traders (COT) Report – June 10:

The latest report showed an increase in long positions and a decrease in short ones. Despite strong signs that the Federal Reserve will keep rates unchanged, news of a significant slowdown in U.S. inflation did not support the dollar, which helped lift demand for the British pound. The key factor for the dollar's future will be Powell's comments on the inflation outlook and his projections for rate cuts later this year.

According to the report, non-commercial long positions increased by 7,404 to 111,076, while short positions dropped by 9,015 to 59,442. As a result, the gap between long and short positions narrowed by 12,378.

Indicator Signals:

Moving Averages Trading is currently below the 30- and 50-period moving averages, indicating potential further downside for the pound.Note: The moving average periods and price levels are based on the H1 chart and may differ from classical D1 moving averages.

Bollinger Bands If the pair declines, the lower band around 1.3405 will serve as support.

Indicator Descriptions:

- Moving Average (MA) – Determines the current trend by smoothing volatility and noise. 50-period shown in yellow; 30-period in green.

- MACD (Moving Average Convergence/Divergence) – Fast EMA: 12; Slow EMA: 26; Signal SMA: 9.

- Bollinger Bands – Period: 20.

- Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Non-commercial long positions – Total long open positions held by non-commercial traders.

- Non-commercial short positions – Total short open positions held by non-commercial traders.

Net non-commercial position – The difference between long and short positions held by non-commercial traders.