Monday Trade Analysis:

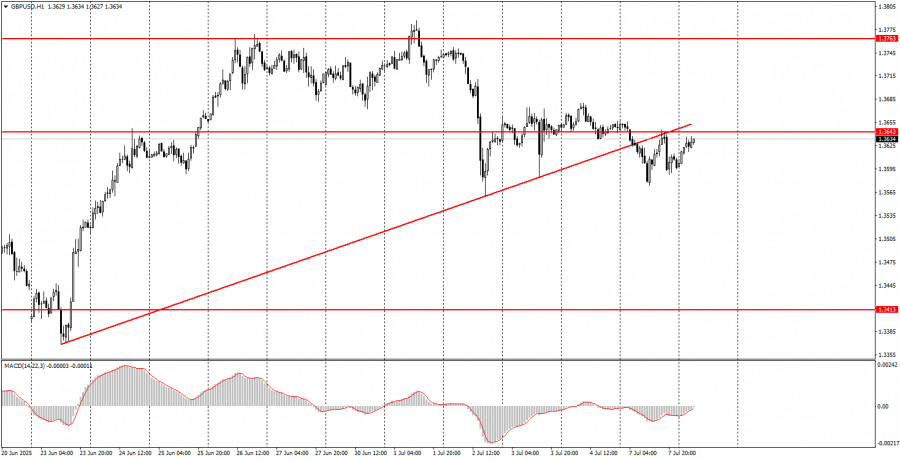

GBP/USD 1H chart

On Monday, the GBP/USD pair was clearly trading sideways. On the hourly timeframe, it consolidated below the ascending trendline, but in our view, this does not open up any new prospects for the U.S. dollar. For the dollar to strengthen, a complete shift in Donald Trump's policy direction would be required. However, what change in direction can we talk about when the U.S. has reached trade agreements with only 3 out of the 75 countries on Trump's "blacklist"? The president himself understands that his plan has failed, which is why he extended the "grace period" until August 1, while also raising tariffs on Japan and South Korea. We believe there is no sign of de-escalation in the trade war. Trump knows that the initial tariff levels could have a negative impact on the U.S. economy, but he either cannot or does not want to step back. America's trading partners understand that these tariffs are not in Trump's own interest and are not rushing to comply with the White House's ultimatums.

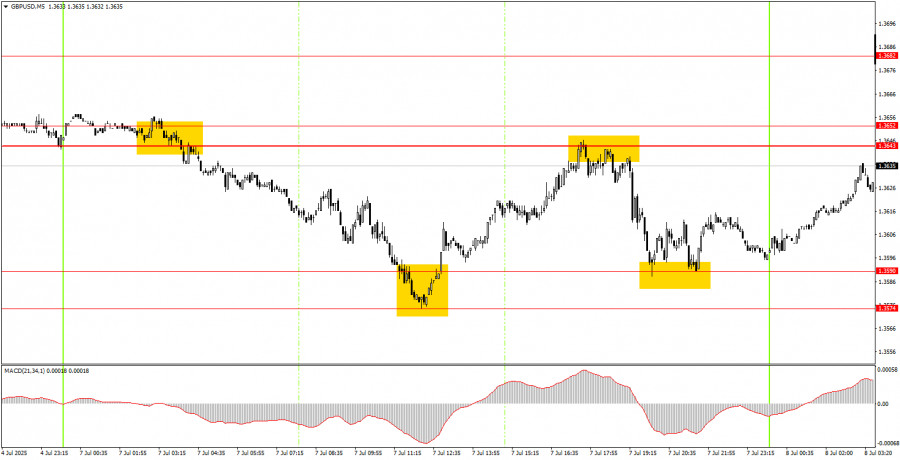

GBP/USD 5M Chart

On the 5-minute timeframe, four trading signals were generated on Monday. The price rebounded twice from the 1.3643–1.3652 level and twice from the 1.3574–1.3590 level. If the first sell signal occurred overnight and was difficult to execute, the other three signals were easier to act on. All three trades could have been profitable, as the target zones were reached in each case.

Trading Outlook for Tuesday:

On the hourly timeframe, the GBP/USD pair experienced a sharp drop last week, but that was the end of the dollar's momentum. In fact, the dollar only strengthened for one day, while many strong U.S. economic reports were ignored. This leads us to the same conclusion as before: traders still have no interest in buying the dollar under any circumstances. Given Trump's recent announcements and his decision to increase tariffs on South Korea and Japan, a strong dollar rally appears unlikely.

On Tuesday, the GBP/USD pair may once again trade with low volatility, as no important events are scheduled for the day. Although the ascending trendline has been broken on the hourly timeframe, we still would not expect a major decline.

On the 5-minute timeframe, trading levels for Tuesday include: 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3518–1.3535, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763, 1.3814–1.3832. There are no scheduled publications or speeches in the UK or the U.S. on Tuesday, so volatility is expected to remain low throughout the day. Market sentiment could be influenced by Trump's tariff announcements. If that happens, the dollar will likely weaken.

Basic Rules of the Trading System:

- Signal Strength is determined by the time taken to form a signal (rebound or breakout). The less time required, the stronger the signal.

- If two or more false signals are formed near a certain level, subsequent signals from that level should be ignored.

- In a flat market, many false signals may form or none at all. In either case, it is better to stop trading at the first signs of a flat.

- Trades should be opened during the European session and closed by the midpoint of the American session.

- On the hourly chart, MACD indicator signals should be used only when there is good volatility and a confirmed trend supported by a trendline or channel.

- If two levels are very close (5–20 pips apart), they should be treated as a single support or resistance zone.

- Once a trade moves 20 pips in the right direction, the Stop Loss should be moved to breakeven.

What's on the Charts:

- Support and Resistance Price Levels – key levels used as trade targets for buying or selling. Take Profit levels can be set near them.

- Red Lines – trendlines or channels indicating the current trend and preferred trading direction.

- MACD Indicator (14,22,3) – histogram and signal line used as a supplementary source of signals.

- Major Reports and Speeches (always listed in the economic calendar) can have a significant impact on currency movements. It's advisable to trade with caution or exit the market during such events to avoid sudden reversals.

Note for beginner traders:Not every trade will be profitable. Developing a clear strategy and sound money management is essential for long-term success in forex trading.