Trade Review and Euro Trading Advice

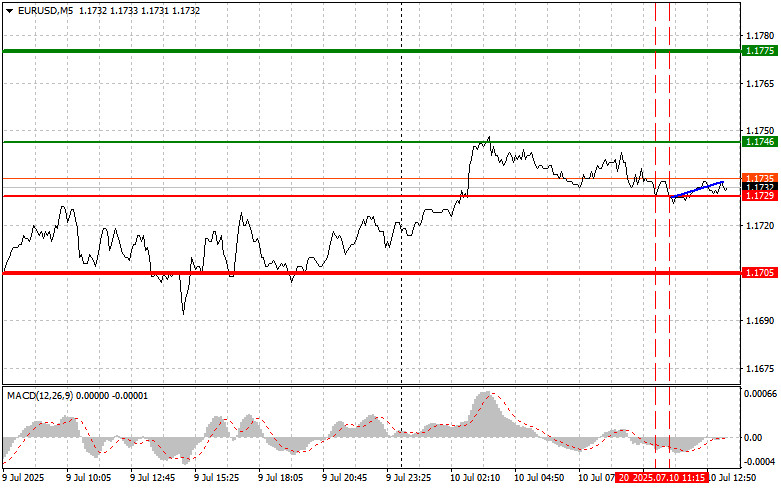

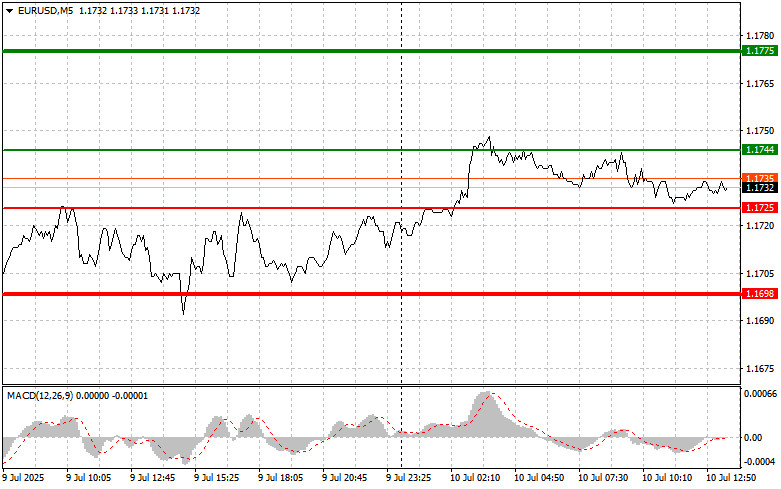

The test of the 1.1729 level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. The second test of this price coincided with the MACD being in oversold territory, enabling the execution of Buy Scenario #2. However, the resulting upward move, as you can see on the chart, was rather weak.

As expected, the German Consumer Price Index confirmed analysts' forecasts, which resulted in low trading activity in EUR/USD and prevented a buy entry point from forming. It is likely that investors had already priced in the expected figures in advance, leading to restrained market dynamics. The lack of surprises in the macroeconomic data kept EUR/USD in a narrow price range, where the pair may remain throughout the U.S. session.

In the second half of the day, attention will focus on the release of weekly U.S. jobless claims and speeches by FOMC members Mary Daly and Christopher Waller. These events are expected to bring more clarity to the Federal Reserve's monetary policy outlook and may help EUR/USD break out of its prolonged sideways movement.

Jobless claims data is typically viewed as a gauge of labor market health, and any unexpected deviation from forecasts could significantly alter expectations for the Fed's next moves. A decline in claims may signal labor market strength and support continued tightening, while a rise could indicate economic weakness and push the Fed toward a more cautious approach.

Equally important will be the speeches by Daly and Waller. Investors will closely analyze their remarks on inflation, economic growth, and rate forecasts. Their comments may offer insights into internal FOMC sentiment and potential policy shifts.

As for the intraday strategy, I will continue to focus on executing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the euro today if the price reaches the level around 1.1744 (green line on the chart), targeting a rise to 1.1775. At 1.1775, I plan to exit the market and consider selling the euro in the opposite direction, expecting a 30–35 point move from the entry. A stronger euro today can be expected only after weak data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1725 level, at a time when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a market reversal to the upside. A rise to the opposite levels of 1.1744 and 1.1775 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1725 level (red line on the chart). The target will be 1.1698, where I plan to exit and buy in the opposite direction (expecting a 20–25 point rebound from this level). Selling pressure on the pair will return if the data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1744 level, while the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a reversal to the downside. A decline to the opposite levels of 1.1725 and 1.1698 can then be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument

- Thick green line – approximate level to set Take Profit or manually secure profits, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – approximate level to set Take Profit or manually secure profits, as further decline below this level is unlikely

- MACD Indicator – use overbought and oversold zones when entering the market

Important Note for Beginners:

Forex market newcomers should exercise great caution when making trading decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-losses, you could lose your entire deposit very quickly, especially if you neglect money management and trade large volumes.

Remember, successful trading requires a clear plan, like the one outlined above. Spontaneous decisions based on current market conditions are a losing strategy for intraday traders.