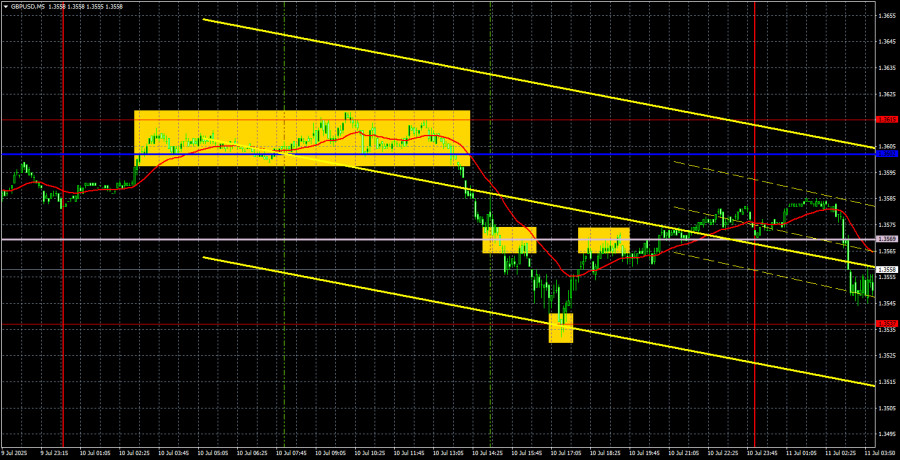

GBP/USD 5M Analysis

On Thursday, the GBP/USD currency pair continued its moderate decline. Over the past two weeks, the British pound has depreciated by 220 points, with approximately 150 of those losses occurring last Wednesday, when UK Chancellor Rachel Reeves became visibly emotional in Parliament. The U.S. dollar strengthened not due to strong Nonfarm Payrolls, low unemployment, or solid ISM business activity indices, but because the market interpreted Reeves' reaction as a sign of serious economic or political concerns in the United Kingdom.

This week, the dollar is also rising, but it's a formal, corrective move that may end at any moment. Given the number of tariffs (which could now reasonably be called "sanctions") that Donald Trump plans to introduce and increase starting August 1, it's unclear why the market is buying the dollar. And Trump's "blacklist" includes 75 countries, while tariffs have so far only been raised for 22. There's plenty of room to escalate, so to speak.

There's been no macroeconomic background this week, though a few reports will be released in the UK today that may attract some interest. However, we don't believe that a market which ignored critical U.S. statistics last week—and Trump's new rhetoric this week—will pay much attention to industrial production or monthly GDP.

On the 5-minute chart, several decent signals were formed yesterday. The price consolidated for some time around the 1.3602–1.3615 level, eventually generating a sell signal, broke through the Senkou Span B line, perfectly reached the 1.3537 level, rebounded from it, and returned to the Ichimoku line. Traders could have opened short positions, and later in the day—long positions. Both trades turned out profitable.

COT Report

COT reports for the British pound show that over recent years, the sentiment of commercial traders has been highly volatile. The red and blue lines—representing the net positions of commercial and non-commercial traders—constantly cross and usually stay close to the zero mark. They are currently also close to each other, indicating a roughly equal number of long and short positions. However, over the last 18 months, the net position has been growing and is currently bullish.

The dollar continues to weaken due to Donald Trump's policy, so for now, market maker demand for the British pound is not especially relevant. The trade war in one form or another is likely to persist for a long time. Demand for the dollar will continue to decline. According to the latest report on the British pound, the "Non-commercial" group opened 7.3 thousand buy positions and 10.3 thousand sell positions. Therefore, the net position of non-commercial traders declined by 3.0 thousand during the reporting week—an insignificant change.

In 2025, the pound will rise sharply, but this is entirely due to Trump's policy. Once that factor is neutralized, the dollar could begin to rise—but no one knows when that will happen. Trump's presidency has only just begun, and the next four years may bring many more shocks.

GBP/USD 1H Analysis

On the hourly timeframe, GBP/USD continues to move downward, as evidenced by the descending channel. The market ignored all the positive macroeconomic data from the U.S. last week, and this week it's ignoring Trump's aggressive rhetoric. Since the price barely managed to break through the Ichimoku lines and the descending channel remains relevant, we can expect further weakness in the pound. Still, it is unlikely to be substantial.

For July 11, we highlight the following important levels: 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3615, 1.3741–1.3763, 1.3833, and 1.3886. The Senkou Span B (1.3569) and Kijun-sen (1.3602) lines can also act as signal sources. A Stop Loss should be moved to breakeven once the price moves 20 pips in the correct direction. Keep in mind that Ichimoku lines can shift throughout the day, which should be considered when evaluating trade signals.

On Friday, UK GDP and industrial production data for May are scheduled for release. However, the market often ignores even quarterly GDP reports, so the monthly data is unlikely to be significant. The price has already failed twice to break below the 1.3537 level, so today we recommend looking for long opportunities. This could be a bounce from the same 1.3537 level. A confirmed break below this level would open the way for shorts with a target of 1.3489.

Illustration Key:

- Support and resistance levels – thick red lines where price movement may stop. Not direct sources of trade signals.

- Kijun-sen and Senkou Span B lines – Ichimoku indicator lines transferred from the 4-hour to the 1-hour timeframe. Considered strong lines.

- Extreme levels – thin red lines from which price has previously bounced. Serve as trade signal sources.

- Yellow lines – trendlines, trend channels, and other technical patterns.

- COT Indicator 1 on charts – shows the net position size for each trader category.