The EUR/USD currency pair continued a mild and weak downward movement on Friday. As we have mentioned many times before, the current move is a pure correction, so there is no need to look for reasons behind the dollar's strength—there aren't any. It should be understood that any instrument or currency pair must undergo corrections, even if the macroeconomic and fundamental background speaks against such movement. In our view, many analysts make one major mistake—they try to justify every (even minor) market movement, completely forgetting the presence of large players who may conduct significant transactions not because a report was released in the U.S. or Donald Trump announced new tariffs, but simply because they need a particular currency for their business operations.

Therefore, we consider the current correction to be a temporary phenomenon. Of course, if the fundamental background begins to change (for which there are currently no prerequisites), then the dollar may transition from a corrective rise to a justified one. But so far, nothing of the sort is happening.

The past week showed that there have been no changes in key issues. The Federal Reserve's position remains rock solid. Regardless of what Trump says, the vast majority of FOMC members do not consider a rate cut at upcoming meetings and expect four 0.25% rate cuts over the next 2.5 years. Trump's demands for an immediate 3% rate cut change nothing. And even next year, when Powell steps down, it's not guaranteed that anything will change. Of course, some FOMC members vying for the Fed chairmanship have suddenly become dovish, but they are still in the minority.

Trump's policy has also remained unchanged over the past week. The U.S. President announced new tariffs (notably on copper and pharmaceuticals) and increased trade duties on several countries that, in his opinion, are slow to negotiate and have not made proposals acceptable to the White House. The number of signed trade agreements also remains unchanged. Over more than three months of negotiations, Trump has announced about 20 deals but has signed only 3. On average, Washington signs one trade agreement per month. The effectiveness and efficiency of Trump's policy are staggering.

Thus, we still see no grounds for a strong rally in the U.S. dollar. It should be understood that the fundamental background cannot and should not trigger dollar collapses every day. A correction is underway, and it could last quite a while. One should remember that, under current conditions, the dollar can only count on corrective movement. There is no need to invent explanations for every microscopic increase in the U.S. currency. There is currently no "rise in risk-off sentiment" or "faith in trade deals with the EU and China." Incidentally, it remains unclear whether Trump has signed a full trade agreement with China. According to one source, yes; according to another, negotiations are ongoing.

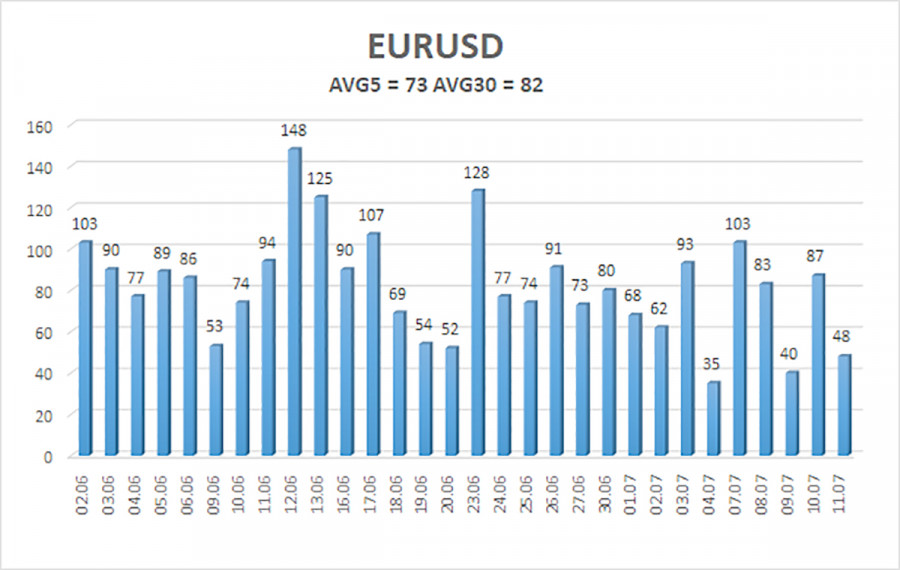

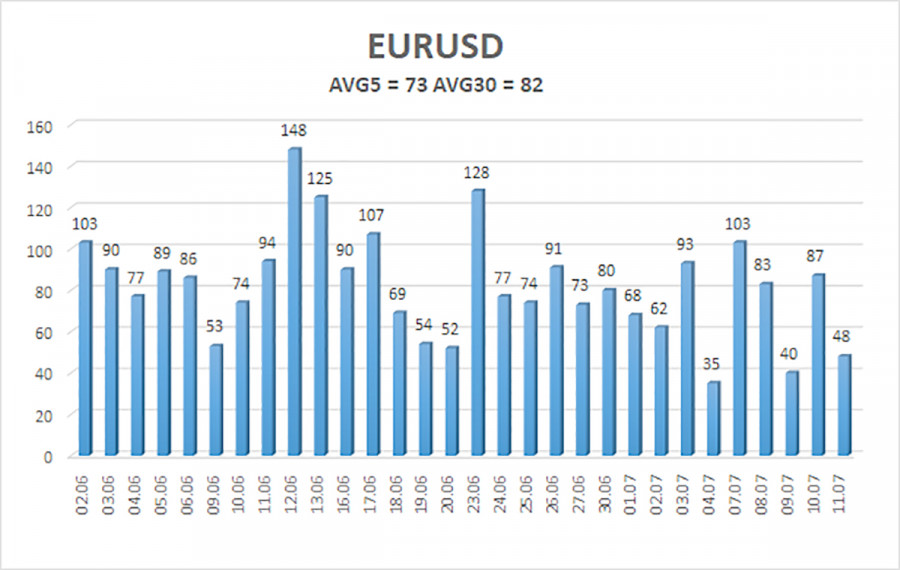

The average volatility of the EUR/USD currency pair over the last five trading days, as of July 14, is 73 pips, which is considered "moderate." We expect the pair to move between the levels of 1.1617 and 1.1763 on Monday. The long-term regression channel is directed upward, which still indicates a bullish trend. The CCI indicator entered the overbought zone and formed several bearish divergences, which triggered the current downward correction.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its uptrend but is currently undergoing a correction. Trump's policy—both foreign and domestic—continues to exert strong pressure on the U.S. dollar. We still observe the market's complete unwillingness to buy the dollar under any circumstances. When the price is below the moving average, minor short positions can be considered with targets at 1.1658 and 1.1617, but under the current conditions, a sharp decline in the pair should not be expected. As long as the price remains above the moving average line, long positions with targets at 1.1763 and 1.1841 remain relevant as part of the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.