The EUR/USD currency pair traded more calmly on Wednesday than it had on Tuesday, remaining relatively stable until the evening. There were no major fundamental or macroeconomic events in either the Eurozone or the U.S. throughout the day. We believe that even the U.S. inflation report published on Tuesday can no longer be considered highly significant under current conditions. More precisely, it remains important, but its influence on the Federal Reserve's monetary policy is no longer as significant as it once was. The Fed remains firm in its stance: first, it needs to understand how the finalized tariffs will affect key macroeconomic indicators, then it will make a decision on the key interest rate. Over the past three months, Jerome Powell has seemed to do little else besides publicly discuss inflation. The Fed Chair has repeatedly warned that the Consumer Price Index (CPI) is bound to rise if import prices increase by 20–30–40%. Especially when it comes to commodities and metals, which cannot be replaced as easily as consumer goods, now that June has arrived, we are indeed witnessing a rise in inflation.

The CPI increased from 2.4% to 2.7% in June. This may not seem like a dramatic jump, but let us highlight two important points. First, Trump's tariffs began to influence inflation in June because, prior to that, American businesses had stockpiled goods at old prices for several months ahead and had neither raised prices nor placed new foreign orders. Therefore, the rise in June inflation is just the beginning. Second, on a monthly basis, CPI rose by 0.3%, which translates to an annualized rate of 3.6%.

Powell and his colleagues suggest that the inflationary shock might be short-lived and that consumer prices may "stabilize" once final tariff rates are set. But what kind of stabilization can we expect when Donald Trump has signed only 3 out of 75 trade agreements, has prepared new tariff hikes for 24 countries starting August 1, and introduced 50% tariffs on pharmaceuticals and copper? This means that average U.S. import tariffs will rise even further from August 1, and even those will not be final. So, if inflation is already accelerating to 3.6% annually at the very beginning of the trade war, what will happen in a few months when tariffs increase further and new ones are added?

We believe U.S. inflation could rise to at least 4–5%. With this outlook (and the Fed surely understands it), there can be no talk of resuming the monetary policy easing cycle—even in theory. Yet, the dollar has been rising for three weeks. If the market has fully priced in the trade war (which cannot be ruled out, although we doubt it), then for the dollar, any further delay in Fed rate cuts and persistent inflation are positive factors. Still, at this point, we strongly doubt that anyone would buy the dollar now for the long term or even for speculative purposes.

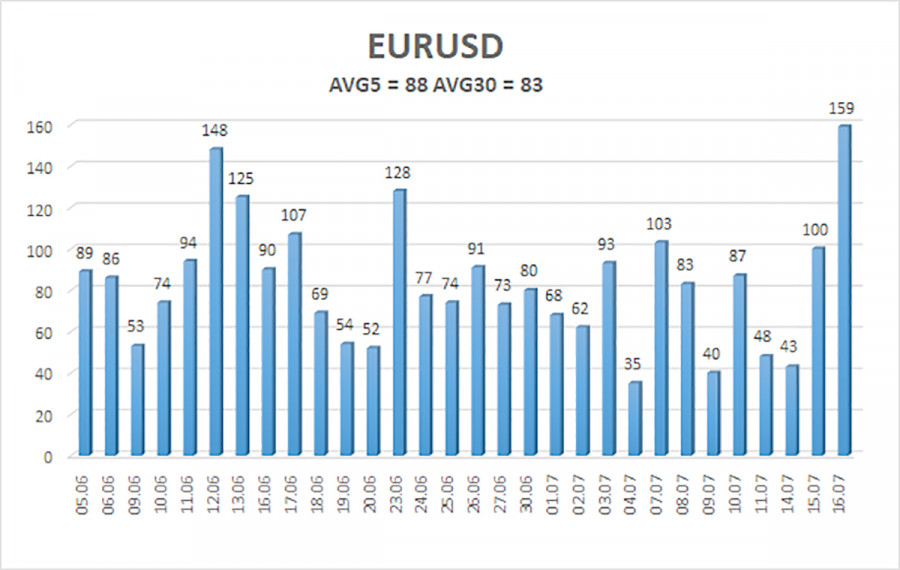

The average volatility of the EUR/USD pair over the past five trading days as of July 17 is 88 pips, which is classified as "average." We expect the pair to move between 1.1564 and 1.1740 on Thursday. The long-term regression channel remains upward-sloping, indicating a sustained upward trend. The CCI indicator dipped into oversold territory, warning of a potential resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair continues its uptrend, although it is currently undergoing a correction. The U.S. dollar remains heavily influenced by Trump's policies, both domestic and foreign. Despite the dollar's recent rebound over the past few weeks, we still do not see grounds for a medium-term buying opportunity.

If the price remains below the moving average, short positions can be considered with targets at 1.1597 and 1.1564, based solely on technical conditions. If the price moves above the moving average line, long positions remain valid with targets at 1.1780 and 1.1841, continuing the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.