The EUR/USD currency pair continued its steady decline throughout Thursday. As a reminder, the forex market experienced an "explosion" on Wednesday evening. Donald Trump once again attempted to either fire Jerome Powell or force him to resign. Naturally, it didn't work again. What's most interesting is that the Fed Chair no longer even responds to the president's repeated attacks. Trump has been trying to fire Powell since his first term, as he had demanded interest rate cuts, which Powell refused to deliver.

What does Trump's persistent desire to cut the key rate indicate? It suggests only one thing: the U.S. president is concerned solely with the wealthiest Americans. Low interest rates are intended to stimulate an economy that began drifting toward recession the moment Trump became president. The Republican's trade war inevitably slows economic activity, and to counteract this, Trump wants low rates. Naturally, this would increase inflation, especially if the Fed cuts rates by 3%, as Trump wants. Consider this: if inflation is rising at a 4.5% rate, what would happen if it were to increase at a 1.5% rate?

However, Trump doesn't seem to care about inflation. He wants to stand on a podium and announce that the economy has grown and that, for the first time in a long while, the federal budget is running a surplus. What the inflation rate is doesn't matter to him. And who suffers most from high inflation? Correct—low-income citizens. Thus, Trump's economic boom and vision of a "great America" will be paid for not just by Americans, but specifically by poor Americans—those who can no longer save money on cheap Chinese goods, who will see their social and medical programs cut, and whose incomes will be devalued by rising prices.

Trump's policy is therefore 100% clear: everyone must pay tribute to America, and inside the U.S., there's only room for the rich. Everyone else should work without weekends or holidays to survive. And all this in the world's wealthiest country. But there's no such thing as "too much money," so Trump wants even more.

Returning to Jerome Powell—realizing he cannot fire him directly, Trump decided to take a different approach. Now, Powell is allegedly responsible for the $2.5 billion budget for Federal Reserve building renovations. According to Trump and his inner circle, this is a clear overspend. Of course, we don't know the real cost of such a large-scale project, but this isn't about repainting a one-room apartment. Besides, Powell didn't personally draft the budget—it was approved by Congress back in 2021. Yes, there was once a time in the U.S. when major decisions required Congressional approval. Those days are gone. Still, the market reacted once again to Trump's attempt to fire Powell—and continues gleefully stepping on the same rake. We've heard similar statements many times, and the outcome is always the same: Powell calmly continues going to work.

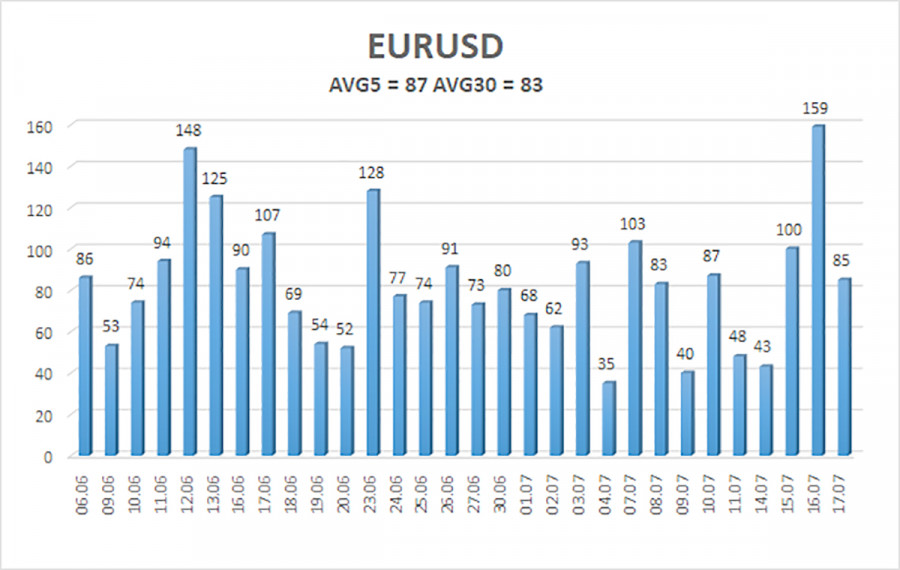

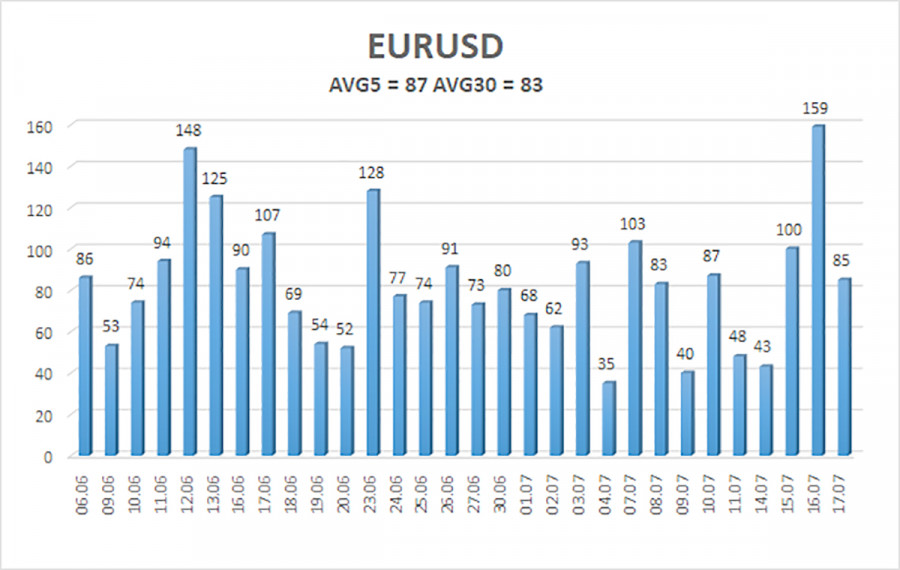

The average volatility of the EUR/USD pair over the last five trading days as of July 18 is 87 pips, which is considered "moderate." We expect the pair to move between 1.1513 and 1.1687 on Friday. The long-term linear regression channel is still pointing upward, indicating an ongoing uptrend. The CCI indicator entered the oversold zone, suggesting that the uptrend may soon resume.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair remains in an uptrend but is currently undergoing a correction. Trump's policies—both foreign and domestic—continue to exert heavy pressure on the U.S. dollar. Despite the dollar's recent recovery over the past few weeks, we still do not consider it a medium-term buying opportunity. If the price remains below the moving average, short positions with targets at 1.1536 and 1.1513 may be considered on a purely technical basis. Above the moving average line, long positions with targets at 1.1719 and 1.1780 remain relevant in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.